There was a time when embedding payments into your software meant becoming a payments company yourself. You had to register as a payment facilitator, manage merchant underwriting and onboarding, handle disputes, monitor for fraud, and somehow stay compliant with evolving regulations. For many SaaS platforms, that overhead was a nonstarter.

But today, platforms like Forward make it possible to offer a modern, profitable payments experience without taking on the operational, regulatory, or financial burden of building a dedicated payments team from scratch.

What It Really Takes to Offer Payments

In 2025, adding payments may seem as simple as dropping in a popular third-party integration. But once your customers start expecting next-day funding, real-time reporting, branded support experiences, or transparency into fees and disputes, the limitations of traditional payment providers become clear.

SaaS companies that want to own the payments experience—and monetize it effectively—quickly realize there’s much more to it:

- Merchant vetting, underwriting, and onboarding

- End-to-end compliance coverage (PCI, NACHA, 1099-K, etc.)

- Reconciliation across banks, methods, and timelines

- Transparent, branded merchant support tools

- Risk and fraud monitoring across your merchant base

- Support for cards, wallets, ACH, and in-person payments

- Transaction-level reporting and revenue visibility

- Dispute and reversal workflows

These are not edge cases—they’re foundational. Traditional processors built for merchants don’t solve them. Forward does.

Embedded Payments, Purpose-Built for SaaS

Forward’s embedded payments platform was designed for SaaS from day one—so you get everything you need to run a modern payments business as a feature, not a department.

Our Managed PFAC model delivers the infrastructure of a payments company—operations, compliance, and risk management included—so you can launch and scale payments without hiring a single payments headcount.

- Merchant Onboarding & Underwriting: We vet, underwrite, and onboard your customers with industry-compliant processes tailored for SaaS platforms, so you’re protected without slowing down your user experience.

- Complete Risk Management: Forward continuously monitors merchant activity and transaction risk behind the scenes. You benefit from smarter insights without needing an in-house risk team.

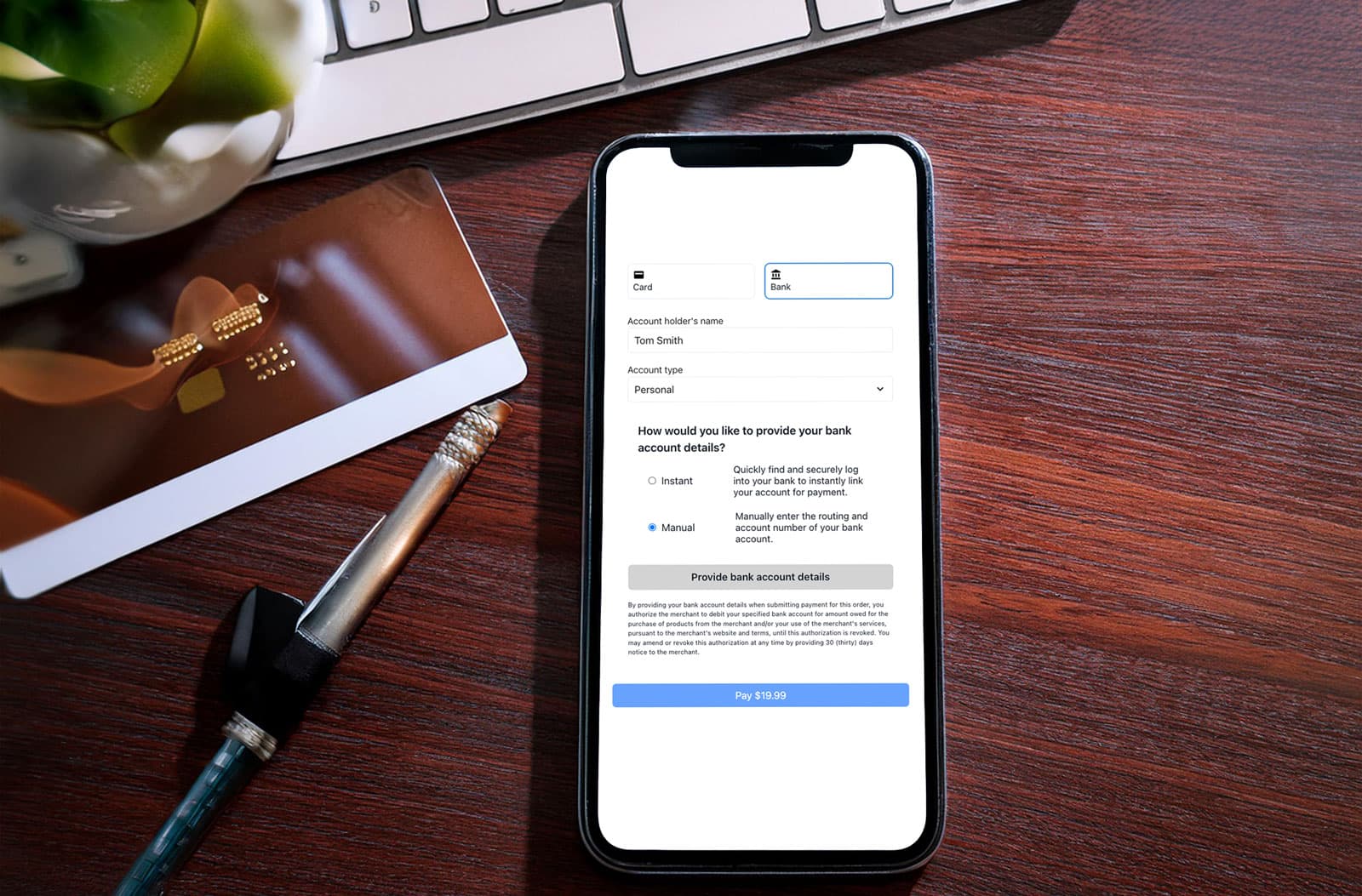

- Multiple Payment Methods, Online & In Person: From cards and digital wallets to ACH and in-person terminals, you can support how your customers want to pay.

- Branded Merchant Portal: Your customers get a fully branded, self-service portal with real-time reporting, granular fee visibility, payment and payout tracking—without ever seeing our name.

- Reconciliation That Actually Reconciles: You and your customers can stop stitching together data and spreadsheets from multiple sources. Forward provides the tools and APIs to match payments, fees, refunds, and payouts across all channels and methods.

- Minimized Dispute Disruption: Our platform helps prevent chargebacks through proactive risk monitoring. When disputes do occur, we provide you and your customers visibility into each case—along with tools to respond, resolve, and learn from them.

- Regulatory & Compliance Handling: PCI, NACHA, 1099-K, OFAC checks—we handle all of it. Your platform stays protected without absorbing the liability or the paperwork.

Focus on Growth, Not Complexity

You want to grow revenue and improve profitability, not spend time and money standing up a full payments team. With Forward, you can:

- Monetize payments directly through a revenue-share model

- Eliminate the overhead of managing compliance, onboarding, fraud, and support

- Shorten time to market with pre-built workflows, portals, and APIs

- Improve merchant retention with transparent fee structures and self-serve tools

And because Forward sits behind the scenes, your customers don’t see a third-party name—they see you.

Final Thought

Embedding payments no longer means becoming a payments company—or settling for a plug-in integration with limited control and upside. With Forward, SaaS platforms get a full-stack payments infrastructure needed to grow revenue, reduce overhead, and create exceptional user experiences—without taking on the burdens that come with traditional processors or full PFAC models.

You focus on growing your platform. We’ll handle the infrastructure that helps you get paid.

Ready to elevate your embedded payments experience? Let’s talk about how Forward can help.