- Revenue you keep

65

%Plan that fits youProtect- Payment volume$50M+

- Saas customers100+

- Payment adoption<50%

- Payments staff0-1

Revenue you keep75

%Plan that fits youMaximize- Payment volume$50M+

- Saas customers100+

- Payment adoption<50%

- Payments staff0-1

Revenue you keep85

%Plan that fits youRails- Payment volume$500M+

- Saas customers1,000+

- Payment adoption>50%

- Payments staff5-10

Revenue you keep100

%Plan that fits youPFAC- Payment volume$2B+

- Saas customers5,000+

- Payment adoption>50%

- Payments staff10+

- What Forward Does

- Payment Loss Insurance

- White label payments sales

- Compliance and registration

- Underwriting and Monitoring

- Developer tools and support

- White label merchant software

- Authorizations and settlement

What Forward Does- Program design, adjustments

- White label payments sales

- Compliance and registration

- Underwriting and monitoring

- Developer tools and support

- White label merchant software

- Authorizations and settlement

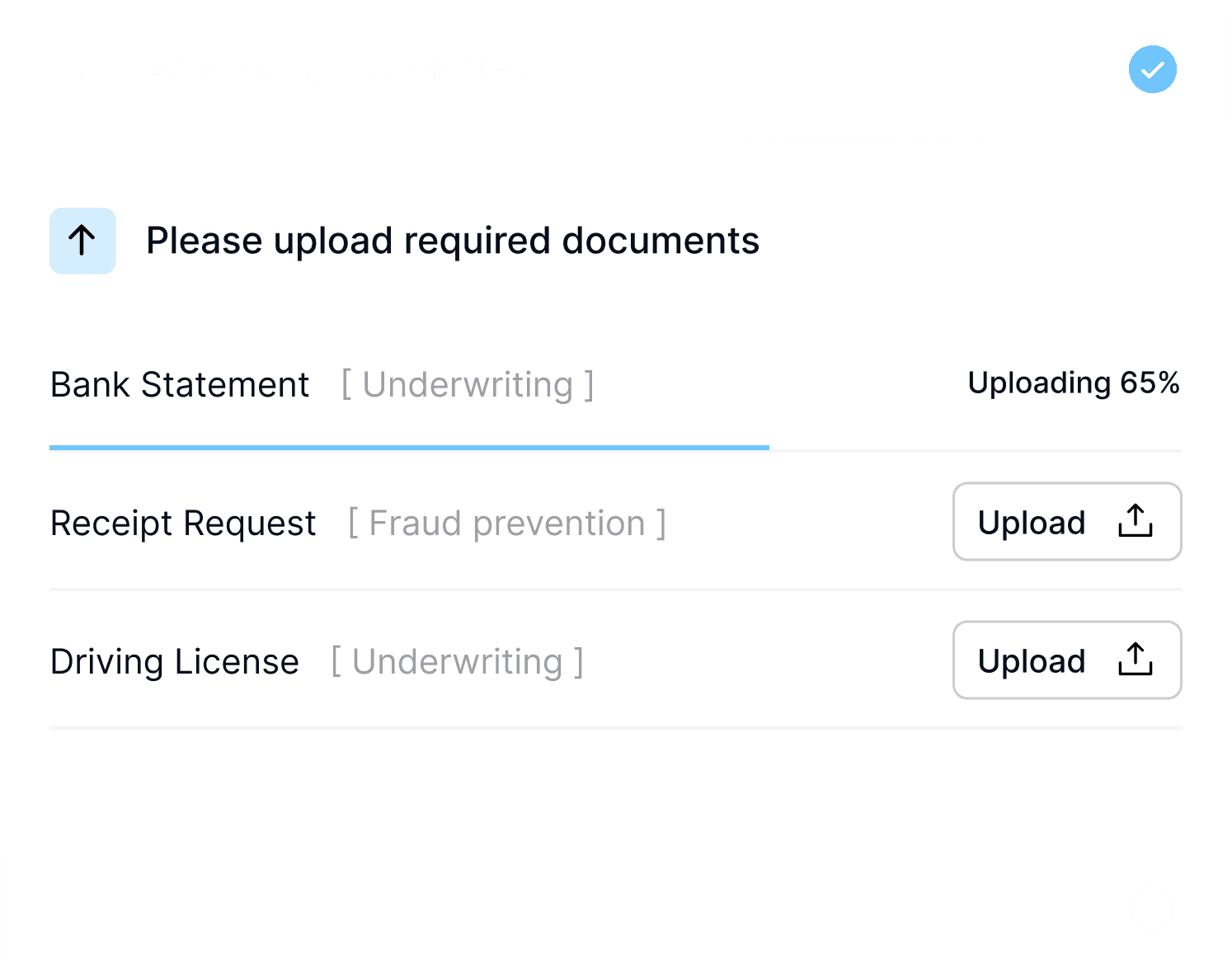

What Forward Does- Compliance and registration

- Underwriting and monitoring

- White label merchant software

- Developer tools

- Developer support

- Authorizations

- Settlement

What Forward Does- White label partner software

- White label merchant software

- Underwriting tools

- Monitoring tools

- Developer tools

- Authorizations

- Settlement

- What saas platform does

- Integrate to Forward

What saas platform does- Integrate to Forward

What saas platform does- Integrate to Forward

- Sell SaaS customers payments

- Onboard and activate customers

- Merchant support

- Program design, adjustments

What saas platform does- Register with networks

- Open an FBO or MTL licenses

- Underwrite new accounts

- Monitor transactions for fraud

- Compliance audits

- Partner support

- Merchant support

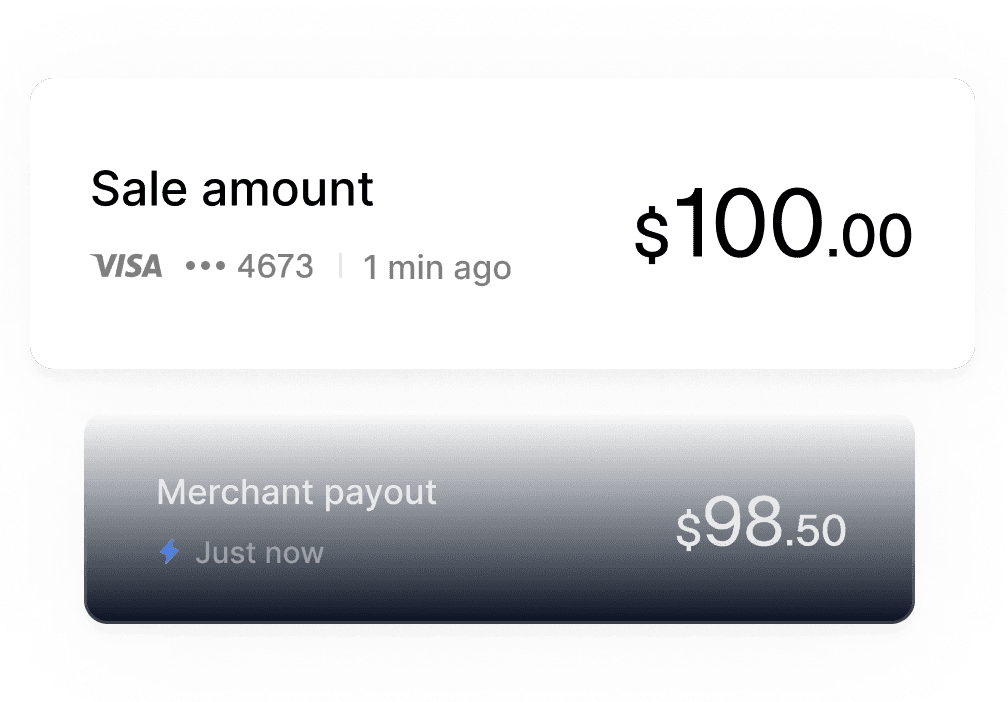

Simplify payments so you can deliver an exceptional experience to your customers. With our platform, you’ll see immediate, measurable improvements in how your merchants manage and receive payments.

Merchants paid on time, every time

No delays, no errors. We ensure your merchants are paid in full, on time, every time so you can build trust and keep their businesses running smoothly.

Tools for perfect reconciliation

Empower your merchants with intuitive tools to match sales with bank deposits, down to the penny. Leave behind manual errors and mismatched records, and give customers the confidence that every cent is accounted for.

Proactive, white-label communication

Enhance your customer service without lifting a finger. With proactive, white-label communications, you can answer payment related questions before they’re even asked. That means fewer support tickets and more satisfied customers.

Grow your payments revenue

Most software platforms join Forward with fewer than 20% of their SaaS customers actively using payments. We’re here to change that. Our proven strategies, expertise, and tailored solutions are designed to help you drive adoption, grow your revenue, and scale your payments program.

Achieve 70%+ payments adoption

With our expertise, we’ll help you turn payments into a core feature that your customers can’t live without. From onboarding strategies to upgrade paths, we drive adoption rates to over 70%, delivering immediate and lasting impact on your revenue.

White-label sales support

Leave the heavy lifting to us. Our team will work alongside yours—or entirely behind the scenes—to sell payments to your existing software customers. With a white-label approach, we handle the outreach, communication, and support while you take the credit.

End-to-end program design

We don’t just implement payments, we craft a program built for you. Our team collaborates to design, price, and execute a strategy tailored to your customers’ needs. From pricing models to key milestones, we ensure everything aligns with your growth goals.