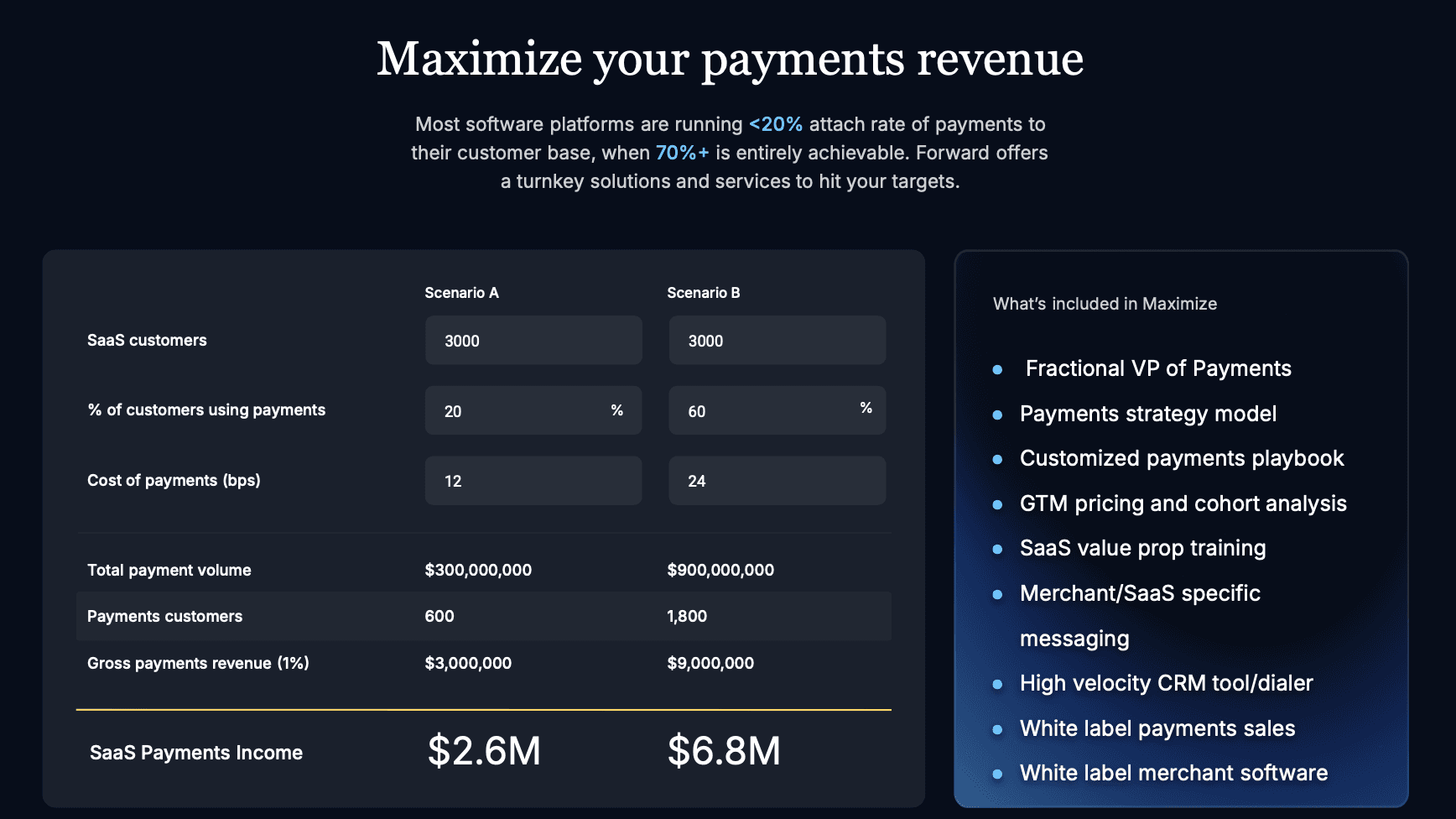

For most software platforms, embedded payments remain a powerful but underutilized lever. At Forward, we often see platforms with only 15–25% of their customers using the integrated payments solution—when best-in-class platforms exceed 60%. That delta represents a massive, often untapped, revenue opportunity.

The math is simple: attach rate is the single biggest driver of payments revenue.

Doubling attach rate can more than double your income—without adding a single new customer.

Why is attach rate so often low?

Every platform is different, but a few common roadblocks come up again and again:

- No one is selling payments. Many small and midsize businesses don’t understand how much they’re really paying. They may assume their fees are below 2%, only to discover their effective rate—including hidden fees—is well over 4%. Without trained reps who can explain the value of your integrated solution, these businesses stick with the status quo.

- Pricing is off. Most teams don’t have access to accurate, market-specific benchmarks. We bring a robust dataset that helps you price competitively for your segment—so you can win deals without leaving money on the table. And because pricing inputs change (thanks, card networks), we help you adjust over time to optimize margin.

- Onboarding is a pain. Every unnecessary question, every manual step in underwriting or sign-up slows adoption. We streamline the process so more businesses complete onboarding—and start processing—with less friction.

Where Maximize Comes In

Maximize is Forward’s end-to-end program for driving payments adoption and revenue growth. It’s built on the lessons we’ve learned helping 1,000+ software platforms not just integrate payments, but turn them into a meaningful business line.

Here’s how it works:

- Get it right from the start. A fractional VP of Payments partners with your team to design a high-converting program—covering everything from pricing and packaging to feature differentiation and positioning.

- Drive adoption through expert outreach. Our white-labeled activation team directly engages customers who use your software but haven’t adopted payments. With clear messaging and hands-on support, we convert 80% of businesses that engage.

- Optimize continuously. We review performance with your team regularly—adjusting pricing, onboarding flows, and other levers to keep attach rates and margins growing over time.

- Scale efficiently with Rails. Once you reach 70–90% attach rate (depending on your vertical), we help you transition to our lower-cost Rails program to maintain performance and improve spread.

Growing a payments business requires more than a product—it takes focused execution. It’s not something you can layer onto a sales or support team’s existing workload. Maximize gives you a proven, high-conviction blueprint—and the dedicated resources to run it—used successfully by platforms ranging from $2M ARR startups to public companies.

Yes, Maximize carries a higher take rate than our self-serve Rails offering. But the tradeoff is clear: our customers earn significantly more overall because attach rates grow faster, margins expand, and revenue compounds. In fact, most platforms using Maximize generate 2–3x more payments revenue than those going it alone—even after accounting for cost.

If you’re not actively driving adoption, you’re not just leaving revenue on the table—you’re capping your growth. Maximize is how you unlock what’s possible.