For many software companies, launching embedded payments starts with one goal: get up and running fast. Developer-friendly APIs make this possible, providing a fast path to implementation for straightforward, direct use cases.

But vertical SaaS platforms aren’t simple. And as platforms mature, so do their operational demands—and the limitations of an API-only approach become clear.

At Forward, we partner with platforms that have already built—or outgrown—their initial payments stack. And what we hear, time and again, is this: “We thought we just needed an API. But now we need more.”

Here’s what “more” actually looks like – and why it matters.

Embedded Payments Require Embedded Support

A clean API integration is just the beginning. Real growth happens after go-live—when your platform customers start onboarding, reconciling, disputing, and asking for help. Your support team can’t be the middleman.

You need infrastructure that empowers your customers to manage their accounts independently, while also equipping your support team with the context they need to provide help quickly and effectively.

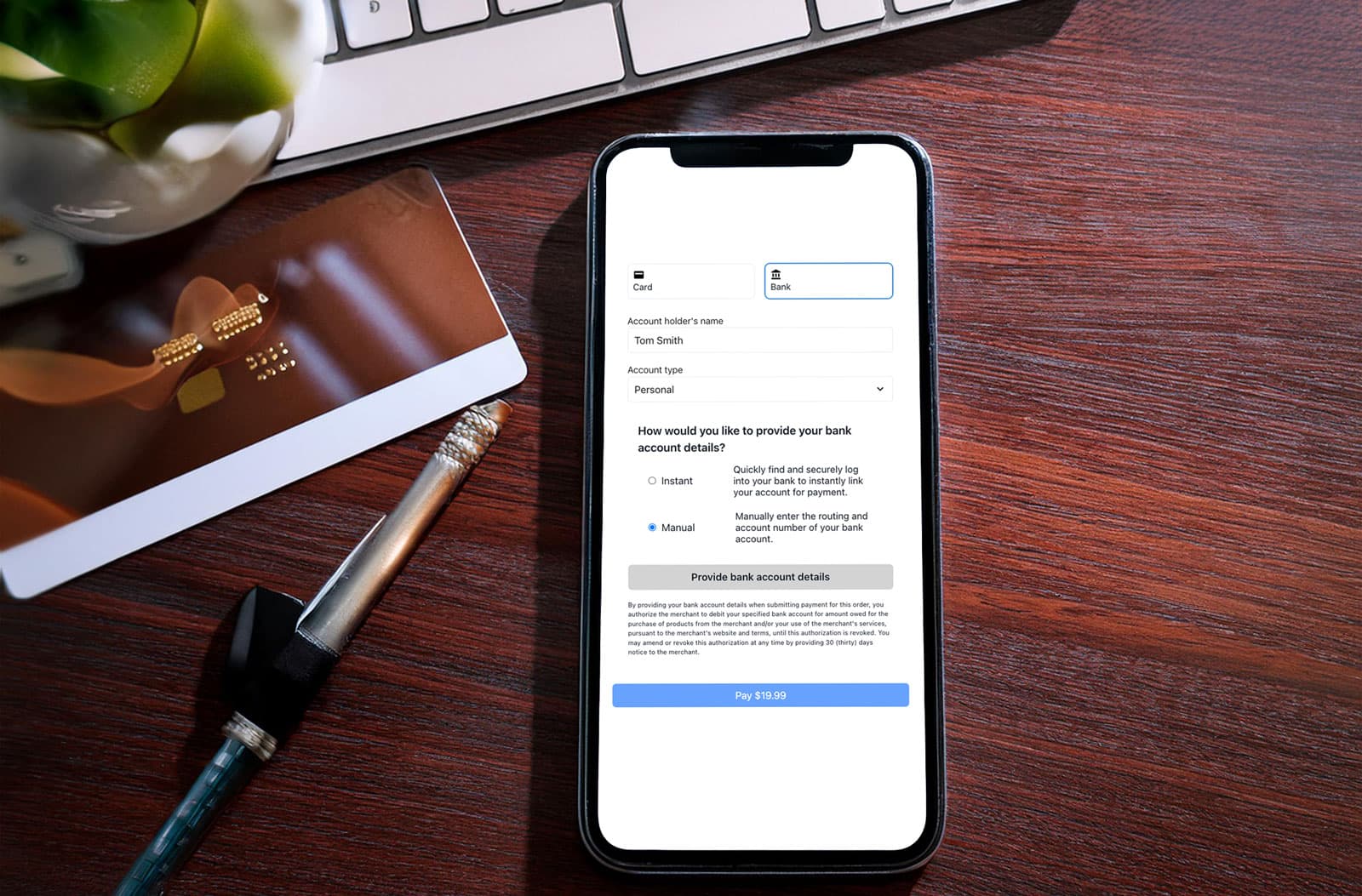

Think branded portals for onboarding, payout visibility, dispute resolution, and reporting. These are not just add-ons—they are critical components of a truly scalable platform.

Pricing Agility Is a Competitive Advantage

Rigid pricing models may work for early-stage platforms, but they become a liability as volume grows or your customer base diversifies. You need the ability to offer custom rates, manage margin by segment, and easily adapt your terms as your business evolves.

Many platforms leave their first provider for this reason alone: the lack of control over pricing strategy.

Brand Control Isn’t Nice to Have—It’s Strategic

Your platform is your brand. Every customer touchpoint, from onboarding to support, reflects that brand. A disjointed payment experience—different UI, external redirects, inconsistent messaging—creates friction and undermines trust.

To build a truly embedded experience, you need white-label capabilities that keep the user journey cohesive and on-brand, from onboarding flows to transactional emails and merchant portals.

Servicing and Risk Should Scale With You

As your platform grows, so do your operational complexities: chargebacks, fraud monitoring, account changes, and support volume. These aren’t just engineering problems—they require coordinated servicing, thoughtful workflows, and a partner who’s seen it before.

A true payments partner doesn’t stop at the technical integration. They provide the tools and expertise to help you implement scalable support and risk processes that evolve with your customer base.

The Bottom Line

For vertical SaaS platforms, payments success isn’t just about building fast—it’s about scaling smart.

Yes, a good API matters, but it’s not enough.

You need a partner that understands what comes after integration. That means combining robust APIs with purpose-built user portals that support customers, streamline operations, and reinforce your brand.

That’s why at Forward, we say: We might not be your first payments integration, but we want to be your last.

Ready to elevate your embedded payments experience? Let’s talk about how Forward can help.