More payments, less pain points

Our platform tackles the challenges that frustrate your customers most. By addressing these pain points proactively, we help reduce friction, improve satisfaction, and minimize the support burden on your team.

Make sure the numbers match

Customers often struggle to reconcile their sales with their bank activity, leading to confusion and frustration. Forward’s industry-leading reconciliation tools provide full transparency.

- Automatically explain each sale and payout in context.

- Reconcile to the penny for complete accuracy.

- Offer customizable settlement windows to fit unique needs.

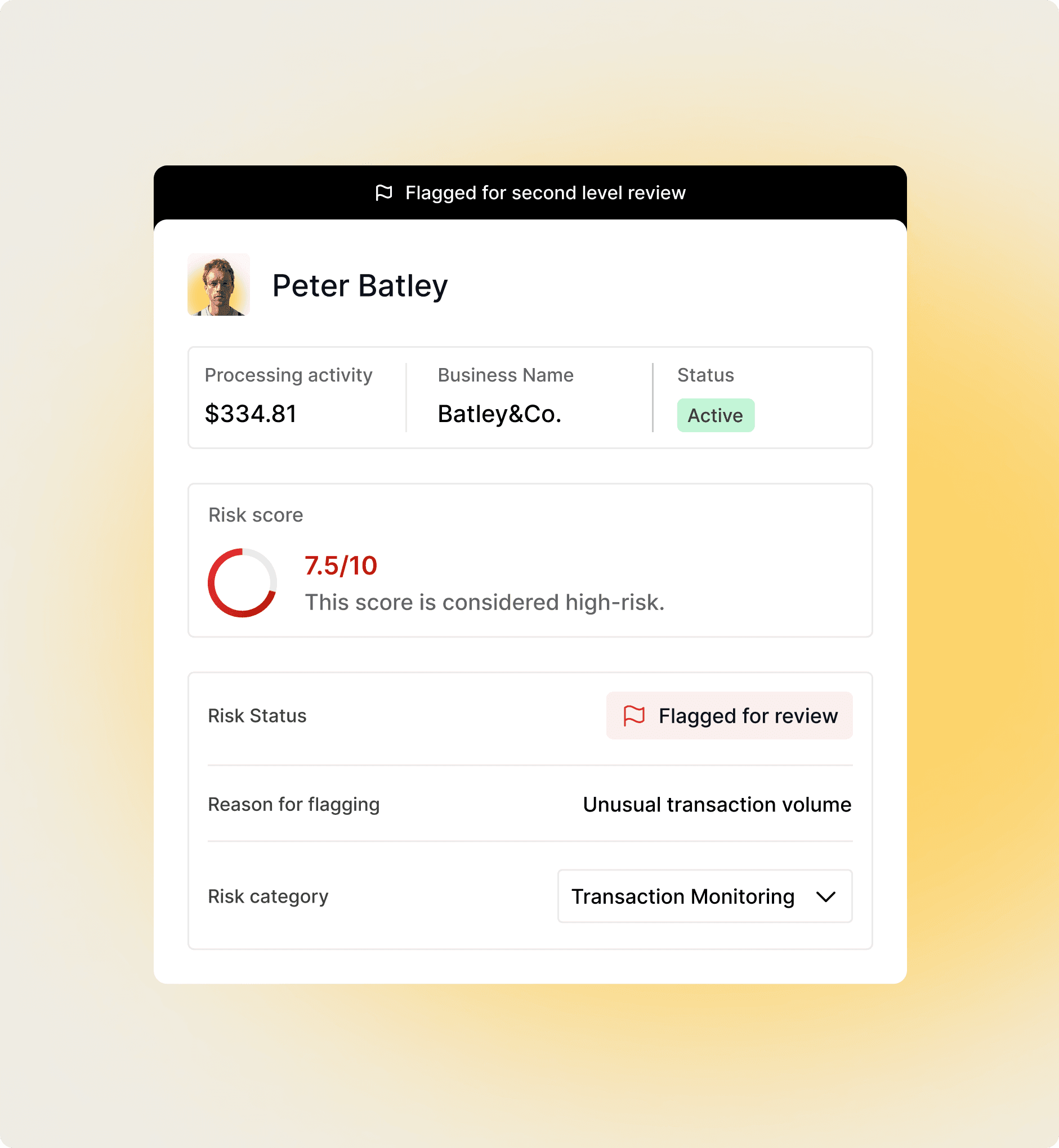

Say goodbye to missing funds

Nothing frustrates customers more than delayed payouts. Forward prevents surprises by proactively flagging risk holds and keeping everyone informed.

- Proactive alerts before payout delays happen.

- Clear, real-time updates on payout status.

- Same-day resolutions to release funds wherever possible.

Increased approval rates

Customers are often held up during the onboarding process due to risk and underwriting delays, preventing them from accepting payments. Forward streamlines the onboarding experience with custom auto-approval flows.

- Tailored approvals based on your software platform’s unique requirements.

- Seamless and frictionless onboarding for faster go-live times.

- Enhanced auto-approvals over time with AI/ML.

Simplify dispute resolution

When customers face chargebacks or disputes, it disrupts their operations and places the burden on them to prove they provided the product or service. Forward’s white-label merchant portal simplifies dispute resolution.

- Tools to track and manage disputes quickly and effectively.

- Step-by-step guidance for winning contested charges.

- Real-time updates on dispute status, reducing uncertainty.

Onboarding

Create payment accounts without friction

Fast, seamless onboarding that removes barriers and gets your customers transacting sooner.

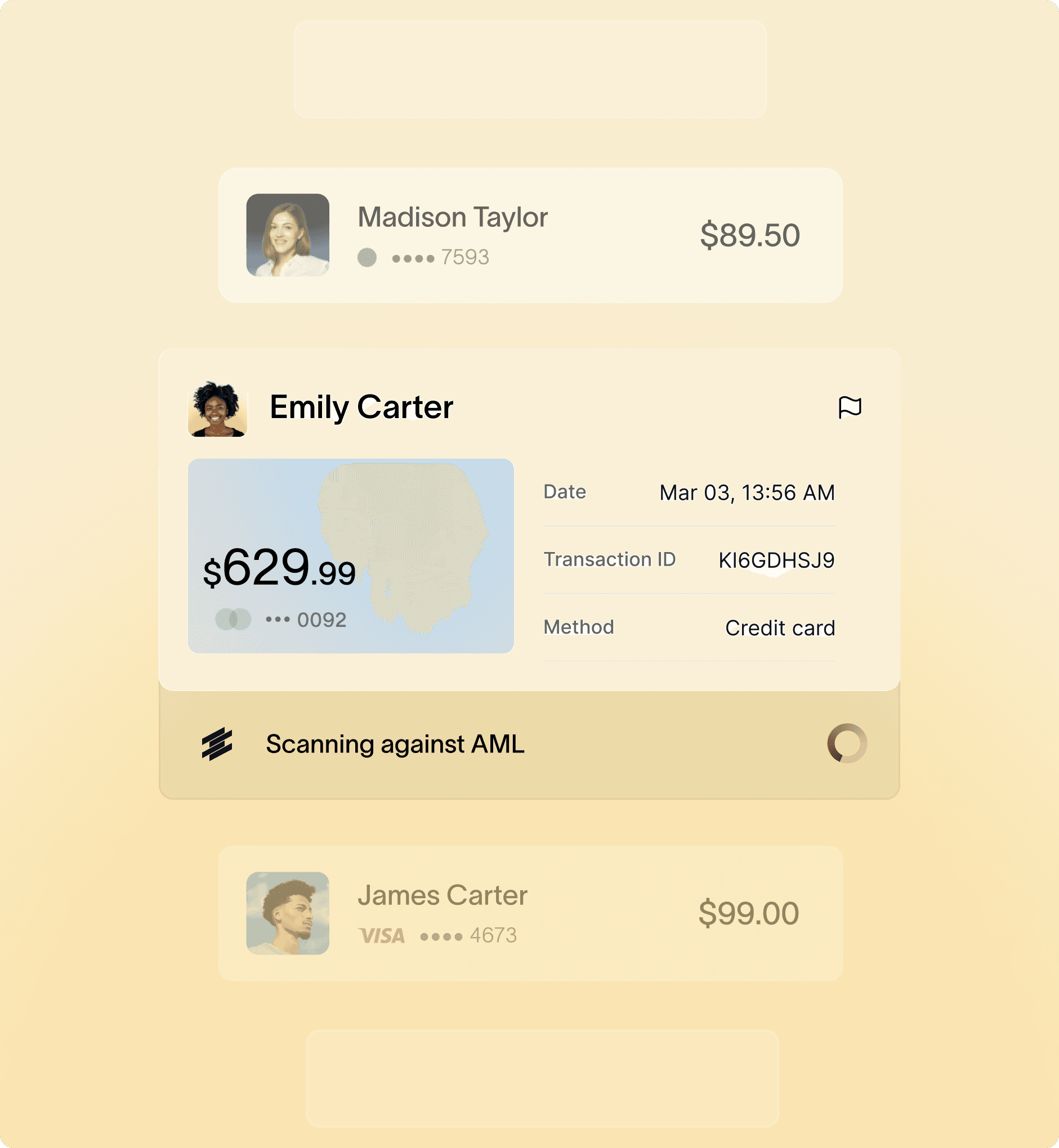

Risk Management

Intelligent, customized risk models tailored to your business

Effective risk management requires striking the right balance between protecting your business and enabling growth. Forward’s Logos risk platform is designed to adapt to your unique needs and workflows, ensuring maximum security with minimal friction.

Compliance & security

A compliant and secure payments program out-of-the-box

Forward handles the heavy lifting on compliance and security, helping you stay protected as you scale so you can focus on growth, not red tape.

Support tools

Self-help tools for your customers, oversight for your team

Empower your users with intuitive self-service features and give your team the oversight they need to manage payments at scale.

White-label merchant portal

A fully customizable portal where your customers can manage their payments experience—including reporting, reconciliation, chargebacks, and more—on their own.

Partner Portal for team oversight

Your team gains full visibility into your payments business, enabling them to assist customers with inquiries and maintain operational efficiency.

Communication Hub (Coming Soon)

Template-driven, white-label communications triggered by operational events. This feature will enable seamless communication between your customers and Forward’s payments program operators, enhancing transparency and trust.