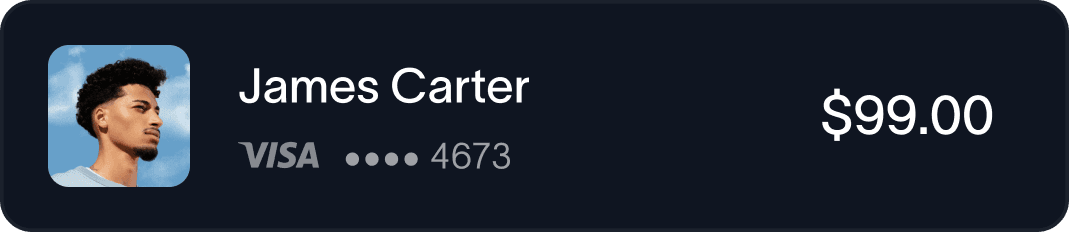

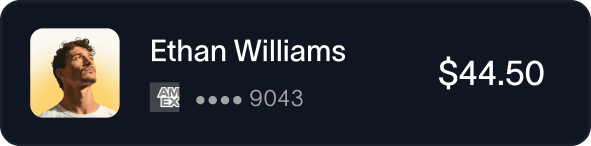

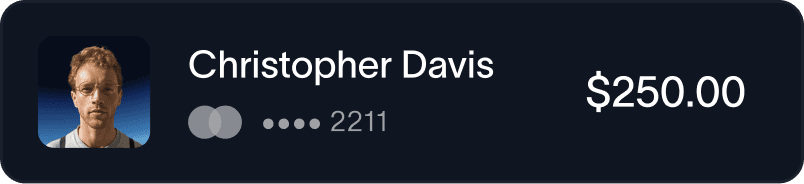

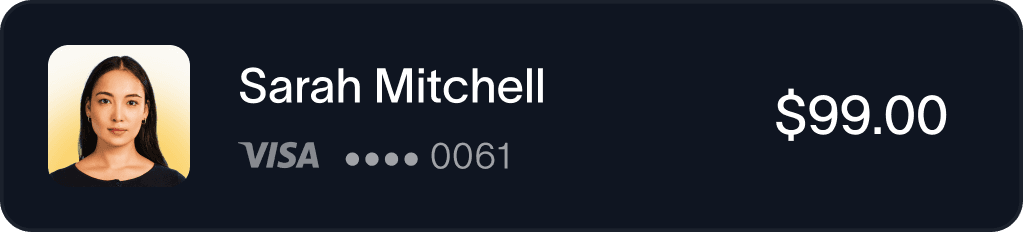

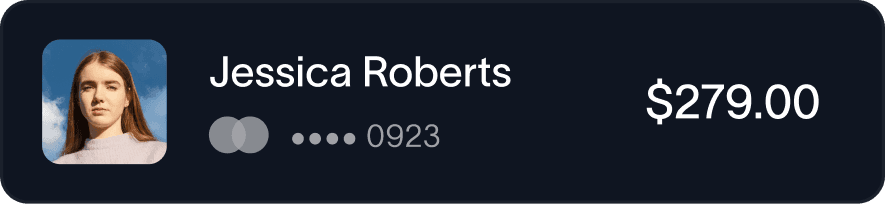

*This visual represents a typical client scenario. Actual revenue and payment spreads may vary based on your industry, transaction volume, and other factors.

A true win-win

Your customers

Streamline payment acceptance and reconciliation, saving valuable time and improving efficiency.

Your company

Unlock a new revenue stream by keeping a portion of the payment processing fees.

Payment networks

Increase prevalence and acceptance of payment cards across more businesses.

Boost your bottom line

Use this interactive example of two SaaS companies to see how changes to key metrics—like adoption rates, volume, and fees—impact their bottom line.

Forget the steps. Get to revenue faster.

Traditionally, businesses take multiple steps to control their payment flow. With Forward, you skip the first two and gain control faster, with better margins.

Choosing business model

Selecting the right model, whether PFAC, WISO, FSP, or referral, lays the foundation for growth and profitability.

Gate 1

Crafting payment experiences

A seamless onboarding, payout, and reconciliation process drives adoption and customer trust.

Gate 2

Pricing payments strategically

Smart pricing strategies optimize margins and encourage adoption across different customer segments.

Gate 3

Defining who sells payments

A dedicated sales team is essential to educate customers and maximize payments adoption.

Gate 4

Optimizing cost of payments

Scaling payments means continuously refining your model and renegotiating terms for better profitability.

Gate 5

We’ve helped over 1,200 software platforms get payments right. Along the way, we’ve identified the challenges that most platforms face and developed proven strategies to solve them.

We are here to help

Whether you’re just exploring your options or need an immediate solution to a pressing pain point, our team is ready to guide you.